Why Building A Stock Portfolio Is a Lot Like Playing Pokémon

Wow, this is niche even by Loot Box standards...

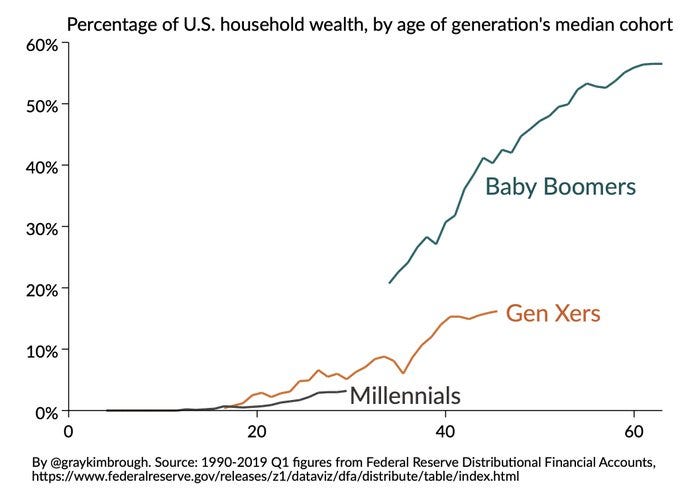

Loot Box as a newsletter exists to be a guide to investing for what I call the gaming generation: A blend of millennials and Gen-Z who either matured alongside games or grew up in a world where gaming has always been mainstream. The wealth disparity between the gaming generation and the Baby Boomers that preceded us is eye-watering. The below chart brings this into sharp contrast. It represents wealth distribution in the US population specifically, but you can find similar stories for the UK and other nations. According to the most recently available data from Q3 2020, Baby Boomers own 53% of US wealth while Millennials control just 4.6%. To put it lightly, we need to be proactive in closing this gap and investing is one of the most sure-fire ways to do it.

One of the barriers to closing this wealth gap is building knowledge and its fair to say that the language around investing can be pretty impenetrable to a beginner. Fortunately, the concepts that underpin sound investing are pretty transferable and one elegant example of this is diversification and how it applies to the beloved gaming franchise, Pokémon.

When you hear that you need to diversify your investments what does that actually mean? Where do you begin? Building out a portfolio of investments is remarkably similar to building out a great team of Pokémon. When you assemble your Pokémon team you’re looking for a broad mix of Pokémon “types”. You might have a fire Pokemon, grass, water, an electric, ground and then maybe a wildcard like a ghost or a dragon. The rationale for this strategy of course is to make sure you have at least one Pokemon with an elemental advantage over your opponent no matter what the circumstances. Fire beats grass, grass beats water and water beats fire. Pokémon is essentially an elaborate game of paper, rock, scissors. So chances are high that you’ve never fielded an all-bug team before because one fart from a Flareon will burn them all to the ground and before you know it you’re waking up in the Pokémon centre feeling embarrassed and $500 poorer.

As with Pokémon, your portfolio and financial position is strengthened by investing across different types of businesses, ETFs (index funds) and other stores of value such as Bitcoin, property and so on. This better positions you to benefit no matter what the markets are doing.

You can also diversify your investments geographically (for example I favour US and UK stocks) and you certainly want to expose yourself to a breadth of different sectors within the world of stocks. For example, a portfolio comprised entirely of high-valuation tech stocks (Tesla, Netflix, Uber, Amazon) means you are extremely exposed to sector volatility. If the market wakes up one day and decides to sell off tech and buy into energy, your entire portfolio is going to get hit hard. If you also owned energy suddenly the two sectors can even each other out, and, over time climb up gradually together.

Put simply, I recommend you spread your eggs (Togepis?) across several baskets to manage your risk to a level that suits you. That being said, some investors with particularly high-risk tolerances do precisely the opposite. Cathie Wood has risen to fame over the last year as the Founder and CEO of Investment Management firm ARK by focusing her firm’s entire strategy on “disruptive innovation” which more or less translates to a portfolio made up entirely of tech companies. During the pandemic ARK has outperformed every other fund as the world switched to the digital world to survive, however, tech has hit some wobbles lately as the world begins to re-open and the headlines have become much less kind. Risk vs reward is the name of the game here.

My recommendation to the gaming generation looking to build long term wealth? If you have a pot of money that you’d like to get started with and you can afford to invest that money for five years or longer, put half into an S&P500 index fund (also known as an ETF). You can think of S&P500 as effectively a bundle of the top 500 companies in America (Apple, Visa, Nike etc) and thus an S&P index gives you a degree of instant diversification. In short, it is a bet on US economic growth. The other half of your investable money you can break up into smaller pots and invest into individual businesses you have a high conviction in, but try to spread these across a few different sectors. Some names I like for the long term right now include AirBnB, Bumble, Pepsi Co, Arcadia Healthcare and Take Two. These names run the gamut across travel, online dating, snacks, mental healthcare and gaming, but of course, you must do your own due diligence and invest in the businesses that speak to you and your own risk tolerance.

As with Pokémon, your choices will be personal to you, so keep them high conviction and make sure you’re not overexposed to any single “type” because you never know when a Gyarados (market event) is going to show up and make life difficult.

Agree or disagree with any of the above? Let me know on Twitter - @LootBoxInvest. Like the ideas? Pass this on to a friend and/or hit that subscribe button and get my posts directly in your inbox.

Not an investor yet but interested to try? I recommend using the FreeTrade app which is free (no commissions on buy or sell), lets you get started with just a couple of pounds and is perfect for newcomers with an easy to use interface. Use this Loot Box Investing referral link and we both get a free random stock when you sign up.

Until next time - CT