The Step By Step Beginners Guide To Investing In Stocks In 2021

Looking to put some savings to work? Here's how to get started with stocks in six simple steps.

Historically, investing in stocks has been one of the greatest tools available to everyday people when it comes to improving social mobility and wealth generation. If you’re looking for a robust explanation of why you should be investing may I direct you to my recent piece on compounding? With this knowledge already digested, I’d like this post to serve as an easy to follow six-point guide for securing your financial future. By the time you’ve read this, you should have everything you need to start benefitting from stock ownership. Let’s get to work.

Step 1: Commit to a long term mindset

I cannot stress this enough: Do not invest money that you are definitely going to need in the next 12 months. If you have plans to buy a home or put a kid through university or if you don’t have any cash savings set to one side, focus on these first. No matter what, please make sure you have a rainy day fund set aside in a savings account and do not touch this money. You never know what life is going to throw at you.

With the money you are able and willing to put to work, it is essential that you hold yourself to a long time horizon. Make peace with the idea that you won’t touch your investments for at least five years. If you’re buying stocks on Monday and selling them on Wednesday you’re not an investor, you’re a trader and statically speaking your odds of losing money as a trader are around 80%. So why does investing for five years work but five days doesn’t?

Step 2: Understand how stock prices move

The simple reality is that over the long term stocks tend to go up. Noted Fund Manager Ralph Wagner elegantly compared the movements of the stock market to a person walking a dog…

“There’s an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch.”

“But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the dog watchers, big and small, seem to have their eye on the dog, and not the owner.”

We can see this visualised when we look at the markets on a longer time horizon. This graph is the FTSE All-World ETF from 2013. You can think of an ETF or index as a basket of stocks blended together. This particularl ETF gives us exposure to a basket of 3,000 large and mid-sized companies from around the world. You can see how over the last ten years when taken as a whole, these 3,000 companies have steadily gained in value…

Have there been times when the dog has darted south and caused a drawdown? Yes absolutely, but these dips should be seen as buying opportunities for long term investors because over the long term when we zoom out like this it’s clear that stocks tend to march higher over time. This is where the timeless expression “Time in the markets beats timing the markets” comes from. If you can wait through short term volatility your chances of making money become exponentially higher over time.

Step 3: Choose a broker (aka pick an app!)

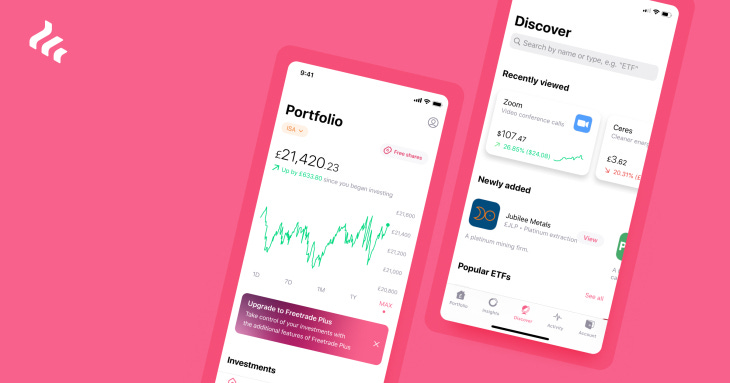

Thanks to the magic of smartphones, buying stocks and building a portfolio is astonishingly easy. There are many apps vying for your attention. My favourite, particularly for beginners, is FreeTrade thanks to its simple user interface and the fact it doesn’t charge transaction fees on anything you buy or sell. Plus it’s pink which is fun! If you don’t yet have an account follow this referral link and you (and I) will get a random free stock so you can hit the ground running…

Once you’re signed up you’re ready to start investing. If you’re concerned about diving straight in with real money you may want to make a practice portfolio on a site like Yahoo Finance where you can set up pretend investments and then monitor the performance so you can get a feel for the process. I will say there is something about using real money that will heighten your decision making and expedite your learnings but it certainly doesn’t hurt to have a risk-free practice first.

Step 4: Start off by diversifying your portfolio with a broad-based index fund

The first thing you’ll want to keep in mind when building your portfolio is the need to be diversified. I wrote this piece to highlight the importance of this, give it a read. In short, you don’t want to put all of your eggs in one basket by over-investing in one business or one sector. For example, if you only buy expensive tech stocks like Netflix, Tesla and Microsoft and the markets decide to sell off tech, your whole portfolio will take a kicking. On the other hand, if you’re diversified across tech stocks, travel, finance, entertainment and energy then you’re not going to feel the pain of a single sector rotation in tech.

A quick and easy way to achieve instant portfolio diversity is to buy into a broader index fund like the FTSE All-World index that I referenced in step 2! In effect these allow you to be invested in hundreds of companies with one buy. Before you do any individual stock picking I recommend allocating the first 50% of your investable cash into an index or indexes. As well as the All-World Index above (ticker VWRL) two other index funds that you may want to look at…

VUSA - S&P 500 Index - Tracks the investment results of 500 of the most valuable US public companies.

IUKD - UK Dividend - Tracks the performance of an index composed of UK companies that pay higher than average dividends from the FTSE 350 Index

Step 5: Picking stocks

With your portfolio foundation laid with diversified index funds you can now begin the fun part - picking individual stocks to invest in. Picking stocks is a highly personal process and how you go about doing this will depend on your own individual investment style. Some investors believe this is a science and use complex chart analysis to identify patterns that may indicate future prices, while others see stock picking as more of an art using narrative and even gut instinct to identify opportunity. Speaking personally I’m somewhere in the middle. I try to identify high-quality businesses with strong balance sheets that are well-positioned to benefit from wider macro trends. What does this look like? A few examples of such stock picks might be Games Workshop, AirBnB and ITM Energy. Each of these benefits from macro trends eg growth in tabletop gaming and entertainment, growth in dispersed travel and growth in demand for green energy. To simplify this task, ask yourself what the world will look like ten years from now. How does the world look? What trends today have continued into the next decade? Which sectors and businesses are best positioned to benefit? Invest in those.

Step 6: Do absolutely NOTHING(!)

Once you invest in stocks you will feel the urge to watch them like a hawk. What’s more, you will feel an almost uncontrollable need to sell your stocks the moment they start to trend down. Do not do this. Fight the urge. When you buy a stock, try to avoid doing anything at all for at least a year. I wrote an in-depth piece on how vitally important it is to do nothing where I illustrated it with this point…

There’s a legend in investment circles that when conducting an internal performance review of their customers accounts from 2003 to 2013, wealth management firm Fidelity learned that the best performing investors on their books were… Dead. In second place? The clients that had forgotten they’d opened the account in the first place.

In general, you want to let your winners run, but every now and then its okay to trim positions if they become outsized. Again, when to trim is a personal decision and something you will come to calibrate with time, based on your own risk tolerance. With that said, you should now have all the information you need to begin investing and setting up your future self for greater financial security.

As always the content provided here is intended to be used for informational purposes only. It is vital to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information presented by Loot Box Investing and wish to rely upon, whether for the purpose of making an investment decision or otherwise. In short: Always do your own due diligence. By investing, your capital is at risk. Until next time - CT

Like this post? Hit that subscribe button and get my posts directly in your inbox every week…

Not an investor yet but interested to try? I recommend using the FreeTrade app which is free (no commissions on buy or sell), lets you get started with just a couple of pounds and is perfect for newcomers with an easy to use interface. Use this Loot Box Investing referral link and we both get a free random stock when you sign up.

Agree or disagree with any of the above? Love or hate this? Let me know on Twitter - @LootBoxInvest.

Great post! I''m glad I came across this on Reddit.